Brazil GEO: Overview of Audience, Verticals, and Ad Specifics

Brazil GEO stands out as a top region for performance marketing due to its massive mobile-first population, growing digital adoption, and explosive demand in verticals like betting, finance, and apps. With low competition in many niches and high conversion potential, it offers ideal conditions for profitable user acquisition. Today, EVADAV explains how to launch successful campaigns in this region and cater to the audience.

Demographics

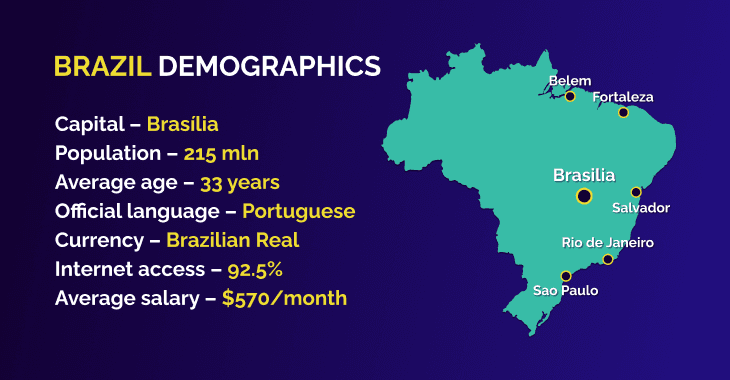

Brazil has approximately 215 million people with an average age of 33. It had 86.6% Internet penetration as of early 2024, making it the fifth-largest Internet population globally. The country also registers over 200 million mobile connections, which reflects deep mobile usage.

English proficiency in Brazil GEO remains quite limited: only 5% of Brazilians can speak any English, and around 1% fluent . The vast majority of the population speaks Portuguese. The median income in Brazil is 3,343 reals per month ($570), and in large cities like São Paulo and Rio de Janeiro it equals 3,500-4,000 reals per month ($595-680).

Religion in Brazil remains diverse: Catholics (56.7%), evangelists (26.9%), and atheists/others (around 9.3%). It influences behavior in dating and gambling in Brazil, especially among the growing evangelical population, which tends to reject casual dating and gambling as morally inappropriate. Catholic users are generally more tolerant but still respond better to value-based, subtle messaging.

The Southeast region (São Paulo, Rio de Janeiro, Minas Gerais, Espírito Santo) is home to 44% of the population, generates about 53% of national GDP (≈ USD 874 billion) – these are the top targets for marketers. Belo Horizonte and Vitória are also cities with a relatively high volume of traffic.

The most popular verticals in Brazil

In Brazil, the leading performance marketing verticals are eCommerce, iGaming, finance, and online dating.

-

The eCommerce sector accounted for 55% of all internet sales in Latin America, generating $346 billion in 2024 with projected growth to $586 billion by 2027, driven by nearly 90% of Brazilians shopping online and 96%+ adult fintech adoption.

-

The iGaming vertical is robust and expanding rapidly, with a reported market volume of USD 2.1 billion in 2023 and anticipated USD 2.6 billion by 2026.

-

In the Finance niche, offers for credit cards, microloans, crypto, and trading are highly trending due to strong mobile fintech use in Brazil.

-

Brazil’s Utilities app market generated around $45 million in revenue in 2022, with annual growth projected to reach $70 million by 2029 thanks to in‑app purchases, paid downloads, and ad placements.

-

Online Dating generated around $57 million in revenue in 2025, served over 16 million users in 2023, and continues to grow, with Tinder and Badoo capturing roughly 60% of the target audience.

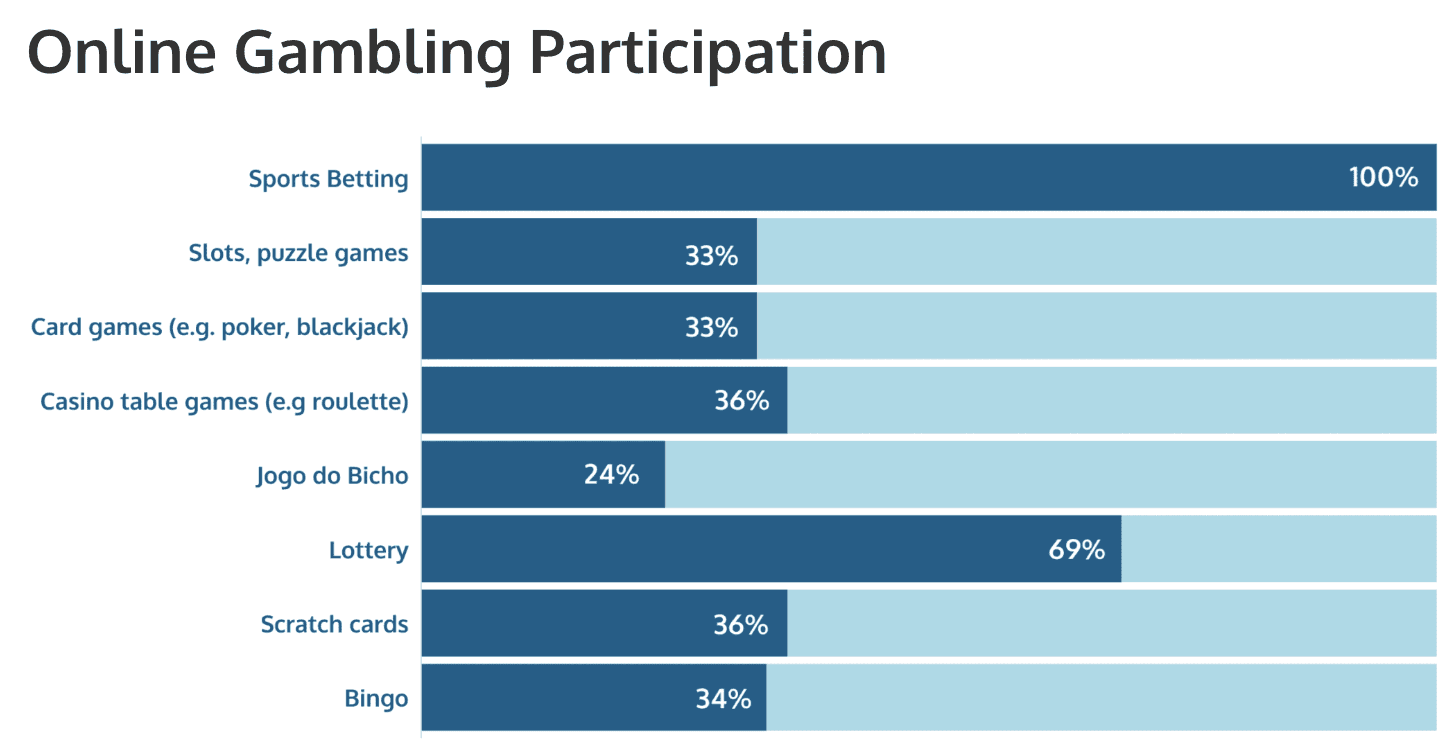

More info on the iGaming market

Source: env.media

Online casinos and betting in Brazil have recently become very popular thanks to clearer regulation and overall cultural acceptance. This segment is expected to generate $1.4 billion in 2025, accounting for 38% of Brazil’s total iGaming Gross Gaming Revenue (GGR).

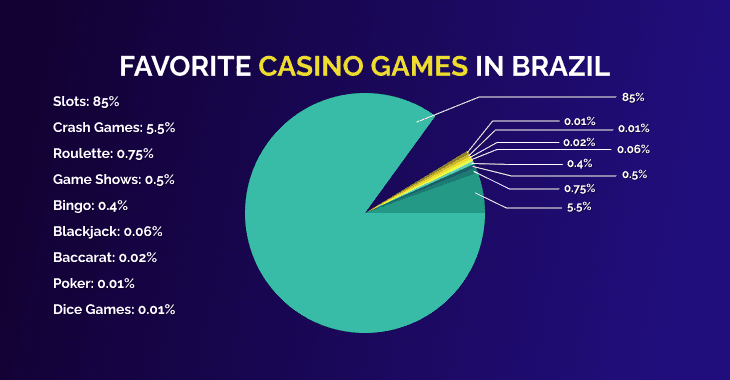

Among Brazilian casino games, slots are the absolute favorite among Brazilians (85%):

When it comes to betting, you should consider launching offers for:

-

Football

-

Volleyball

-

Boxing / MMA

-

Basketball

-

eSports

The study by ENV Media shows that 50% of sports bettors make bets weekly, and 21% – daily. This indicates a huge level of betting traffic in Brazil.

What about the legal standpoint?

Sports betting and casinos in Brazil became legal in 2025, after the Ministry of Finance introduced a few regulations. Online casino operators must obtain a license, implement AML/KYC policies, and avoid credit cards or crypto payments.

When launching advertising campaigns, ensure offers meet legal requirements: no guarantees of wins, include an “18+” notice, and link to responsible gambling. Stay compliant: work only with licensed operators and .bet.br domains, avoid credit card/crypto targeting, and adhere to anti-welfare guidelines.

Popular Ad Formats in Brazil

Consider performance marketing campaigns with the following ad formats:

-

Popunders show a high conversion rate for online shopping or video streaming. They open quietly behind the main tab and appear only when a user closes the active window, minimizing disruption and maximizing visibility.

-

In-page ads are also highly effective across Brazil’s top verticals like sports betting, ecommerce, utilities, and finance. Use them for financial blogs, betting tips, or product reviews, where users are already engaged.

-

Brazilians are constantly on their phones, and push ads naturally fit into this mobile-first behavior. Since they require user permission, they don’t come across as intrusive, making them ideal for delivering quick updates about offers while someone scrolls Instagram or checks the weather app.

-

Native ads match the look and feel of the platform, making them perfect for eCommerce, Finance, and Utility offers. They can highlight seasonal deals, app installs, or betting promotions without interrupting user flow.

How to Make Advertising Campaigns in Brazil?

What to keep in mind when making creatives for the Brazil GEO?

Brazilians are deeply patriotic and emotionally connected to their country, making national colors and symbols powerful tools in ad design. Creatives that incorporate the green, yellow, and blue of the Brazilian flag or reference unity and national pride tend to resonate strongly.

Brazilian gamblers engage in betting to unwind and reduce stress, so your messaging should highlight relaxation, fun, and a mental break from daily routines. Also, they love variety and value: special promotions, bonuses, gifts, and discounts are all highly effective for performance marketing in Brazil.

Since English proficiency is low, all creatives must be fully localized into Portuguese. Not just translated, but adapted to the Brazilian dialect, which differs significantly from European Portuguese.

Finally, note that traffic arbitrage in Brazil works well when combining social networks + messaging apps (like WhatsApp), directing traffic to localized, compliant offers. Besides, you can integrate various promotions in your post-click funnel: upsells, engagement boosters, cashback, and retention programs.

Summing Up

Brazil GEO is ideal for mobile‑first performance marketing. Beyond a thriving iGaming market, it offers great opportunities for traffic arbitrageurs working with eCommerce, Finance, and Utilities verticals. Just make sure to localize creatives and analyze user behavior in different cities.

Need guidance with traffic arbitrage in Brazil? Contact your dedicated manager in one click through the EVADAV dashboard – we know this GEO well and are ready to help you with targeting, creatives, and analytics.