IGaming ads in 2026: what changed and how to work with it

The last year has become a turning point for everyone earning by promoting online casinos and betting. The regulation of gambling advertising is moving to the top of the agenda in many countries, while major platforms such as Google, Meta, and Telegram have sharply tightened their ad policies. With 2026 ahead, this wave of restrictions is not going away - it’s likely to intensify.

In this article, we break down what exactly has changed, which countries have already implemented new rules, and how to adapt your campaigns to the new reality without losing revenue.

Why this affects every advertiser

A recent iGaming Future 2026 study conducted by EvenBet Gaming shows evolution in executive priorities: for the first time, regulatory compliance has leapfrogged competition and market expansion as the top concern of iGaming executives.

The reason for all this is the pace of change. In November 2025, Google reclassified sweepstakes casinos from "social games" to gambling. Therefore, advertisers require a real gambling license to advertise through Google Ads. At the same time, Google updated its list of countries where advertising land-based casinos is entirely prohibited, including India, Indonesia, Italy, Lithuania, the Philippines, Ukraine, and dozens of other markets.

Moreover, Meta changed its position: instead of the previously existing whitelist of countries with allowed gambling ads, now there is a focus on blacklisted countries, and advertisers themselves are fully responsible for complying with local laws. On its part, Telegram has conducted a massive cleanup of bots and channels related to gambling content.

By 2025, the global online gambling market reached an estimated 103–108 billion dollars, and analysts forecast growth to around 169 billion by 2030. Despite this potential, earning in the niche is becoming more challenging: regulators are tightening controls to protect vulnerable audiences such as minors and people susceptible to developing an addiction.

What changed in the law by the beginning of 2026

Lithuania: moving toward a full ban

Lithuania is gradually limiting the promotion of gambling. All outdoor advertising has already been banned. On TV, radio, and online, only betting can be advertised during specific time slots, and is subject to content regulation. The last step will be implemented in January 2028: a general ban will apply to gambling advertisement and sponsorship. To soften the blow on the media market, 4 million euros have been allocated from the state budget as compensation.

Croatia: ban starting in 2026

A new law will come into force on 1 January 2026. It severely narrows down the available inventory:

-

printed advertising will be prohibited;

-

TV and radio ads will only be allowed at night;

-

direct links to casino websites and bonus offers will be fully banned.

United Kingdom: new rules from December 2025

Several consumer protection measures have been introduced by the UK Gambling Commission. As of 31 October 2025, deposit limits must be set before the first deposit for all consumers.

From December 19, 2025, additional rules apply:

-

bonuses with wagering requirements above 10x are banned;

-

mixed promotions combining several product types, such as betting plus casino, are restricted.

Since May 2025, stricter marketing consent rules have also been in force: operators need to obtain separate consent for each product and each communication channel. From September 2025, the UK advertising code extends to overseas companies licensed in the UK, even though they are registered in other countries.

Brazil: legalization with strict conditions

Brazil has legalized online casinos and betting, but in the strictest possible way. The tax on gross gaming revenue was increased from 12% to 18%, and since January 2025, only SPA-licensed platforms can operate.

This was significant for budgetary impacts: in the first five months of 2025, Brazil collected taxes from betting that exceeded 3 billion reals for the first time, which is tens of thousands of percent more compared to the same period in the previous year. This made advertising even easier: no money images, mandatory 18+ labels, and visible links to responsible gambling resources.

Germany, Spain, the Netherlands: timing is everything

While Germany prohibits gambling advertising between 6 a.m. and 9 p.m. together with other promotions, Europe has no such timing restrictions. Spain goes even further: It allows advertising between 1 a.m. and 5 a.m. only. It also prohibits sports sponsorship and celebrity endorsements in advertisements.

The Netherlands is also about to impose new restrictions. It set out to establish a single limit on deposits and losses across all licensed operators and to raise the minimum age for high-risk games to 21.

Ireland: Daytime Blackout

Under the new Gambling Regulation Act, it prohibits gambling ads from 5:30 a.m. to 9 p.m., a period that considerably reduces daytime accessibility.

India: total ban on real-money games

In August 2025, India enacted a law banning all forms of online real-money games and removed the legal differentiation between games of skill and games of chance. Offenses are punishable by fines of up to 10 million rupees (approximately $120,000) and imprisonment for up to three years.

How these changes affect advertising

Ad costs are rising, options are shrinking

Google now requires a separate certification for gambling ads for each country and each domain. In several markets, personalized ad targeting for casino products is not allowed. Meta has publicly stated that compliance is the advertiser's responsibility. Without precise targeting, the cost of acquiring a player grows, while conversion rates typically go down.

Timing and content are tightly regulated

Most EU countries allow gambling ads within specific time frames. Germany and Ireland permit it only after 9 p.m.; in Spain, it is between 1 a.m. and 5 a.m. Several regulators prohibit using celebrities or sports stars in the creatives, while in other jurisdictions, no promotion of welcome bonuses is allowed.

Shift of focus to retention

The industry is changing its priorities. Operators take less aggressive approaches to new markets and focus more on retaining active players. According to EvenBet Gaming, almost one-third of companies in Asia consider working with the existing customer base a top priority; this is true for one-fifth of operators in Europe. Investments are directed toward personalization, localized content, and detailed behavioral analytics.

How to adapt your ad campaigns

Rethink your creatives

First of all, remove:

-

aggressive promises and “get rich quick” messages

-

visuals with cash

-

direct “casino” wording (it can cause moderation issues)

Instead, focus on:

-

entertainment and gameplay

-

quizzes and skill-based mini-games

-

eSports-related betting angles (when allowed)

In regulated markets, always include age labels and evident responsible gambling disclaimers. This ensures that moderation passes and will earn long-term trust from the audience.

Switch to alternative formats

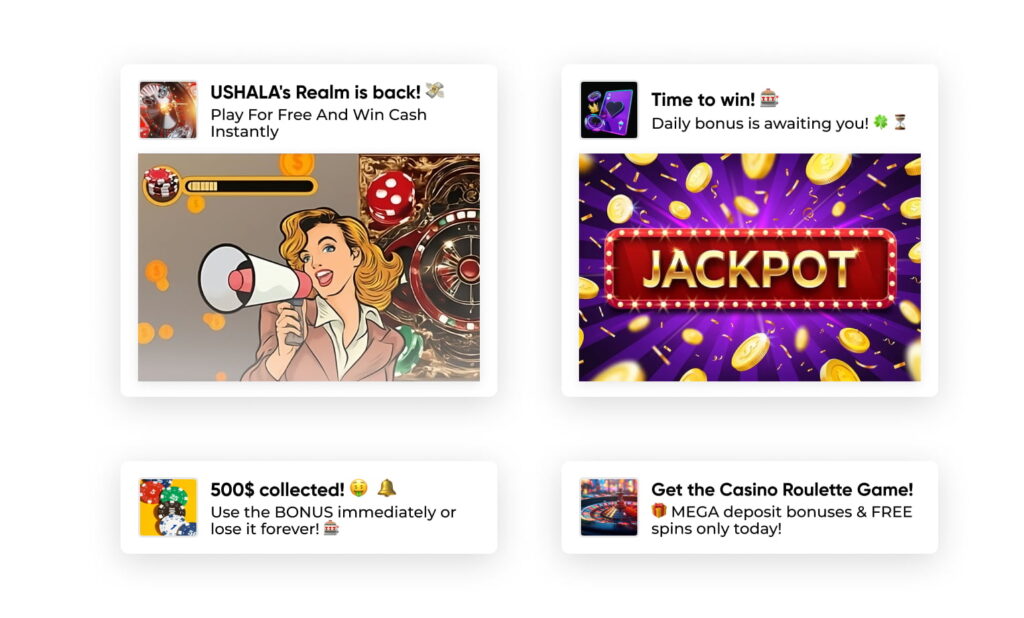

When your campaigns get limited or blocked by Google Ads, Facebook, and TikTok, alternative traffic sources shine. EVADAV offers four formats that work great for casino and betting product promotion in compliant GEOs:

Popunders - they open in a new browser tab or window, high reach, and mobile traffic works best.

In-page - on-site notifications running straight in the browser window; no subscription is needed. Usually, they have a higher CTR than classic push

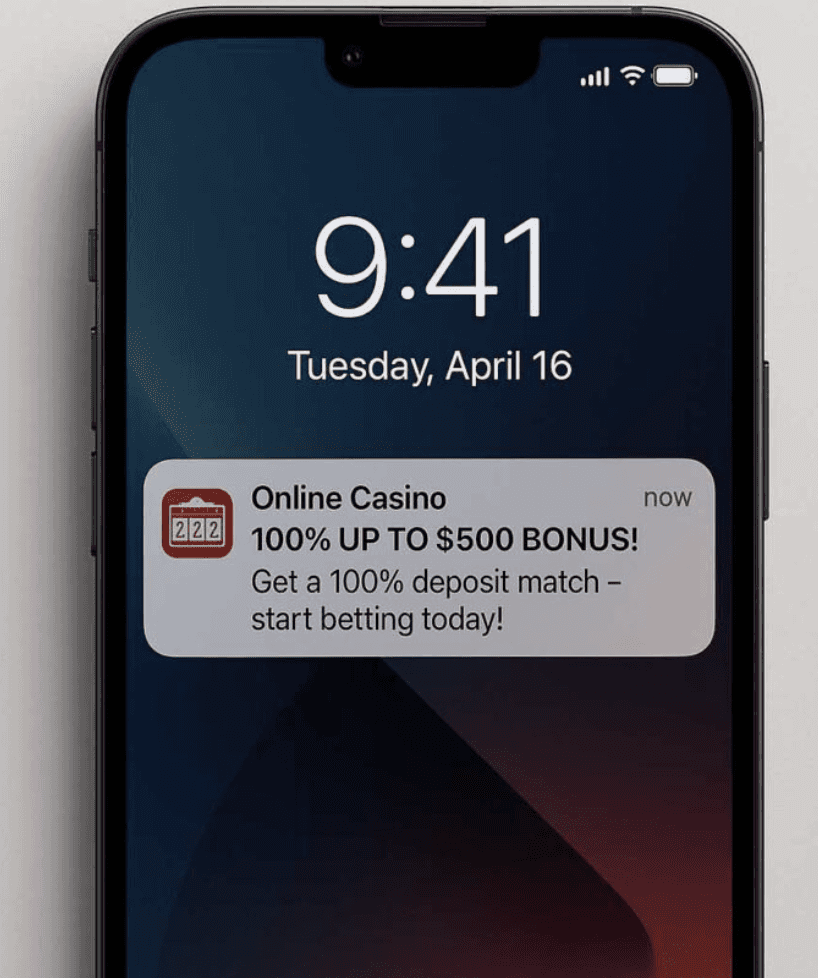

Push notifications - direct contact with users who opted in to receive these messages. Great for retargeting, reactivation, and time-sensitive offers.

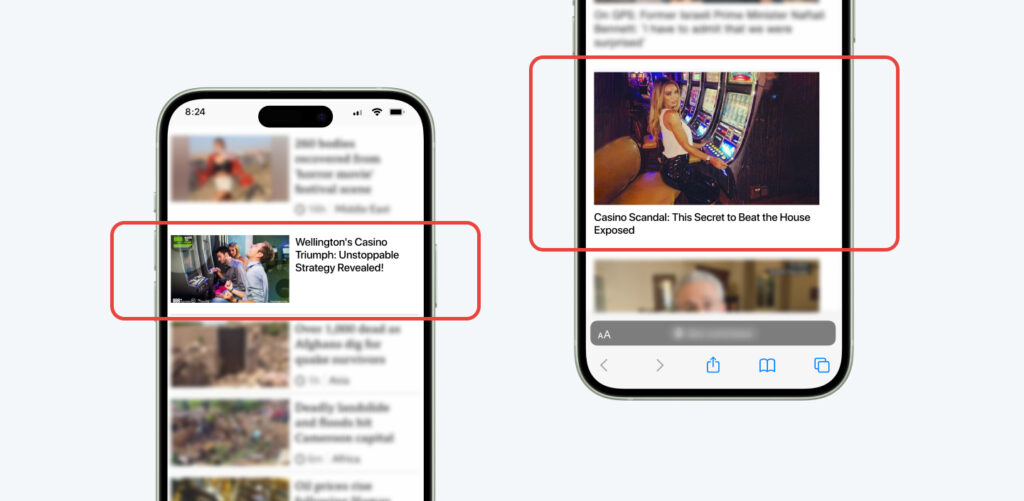

Native ads - blends within the content of the site and brings in more qualified, "warmer" users without annoying them.

By moving through other formats, advertisers can continue to build their funnels, even where the air is thinning, within the source.

Pay attention to emerging markets

While Europe and the United States continue to tighten regulation after regulation, Latin America and Southeast Asia still present a landscape of enormous growth potential.

With a forecasted iGaming market size of around 6–7 billion dollars by the end of 2025, Brazil is becoming a regional leader.

The effective tax burden has been reduced for licensed operators in the Philippines, as they go all out to promote a regulated iGaming industry.

Besides formal prohibitions, Indonesia has an online gambling market estimated at roughly 4 billion dollars by 2025.

These markets also tend to have lower customer acquisition costs and comparatively better mobile engagement, alongside very strong demand for digital entertainment.

Why choose EVADAV

When global platforms restrict or completely block gambling-related campaigns, EVADAV remains a practical and predictable tool for advertisers working with casino and betting offers.

Fast moderation

Campaigns are reviewed in hours, not days. This is crucial when you need to launch ads for a major sports event, seasonal spike, or limited-time promotion.

Dedicated account manager

A personal manager helps you:

-

choose the right bundle of format + GEO

-

configure targeting in line with regulations

-

optimize bids and creatives based on live statistics.

This support significantly shortens the testing phase and reduces the risk of burning budgets on non-working hypotheses.

High-quality traffic in promising regions

EVADAV delivers billions of impressions per day across Latin America, Asia, and Europe — regions that show consistently strong performance for casino and betting verticals. A low minimum deposit makes it possible to test new markets and formats without heavy upfront investments.

Key takeaways

In 2026, a significant iGaming market shake-out is expected by industry experts. Only those companies and media buyers who learn to work within constantly changing rules will stay and grow.

Compliance is no longer a box to tick — it is a core business skill. To stay competitive, it is essential to:

-

use entertainment-focused, compliant creatives

-

move away from overly aggressive formats and promises

-

diversify traffic sources and lean on alternative formats

-

explore and scale in emerging markets with adequate regulation and demand

🎲 Launch iGaming campaigns with EVADAV and enjoy fast moderation with quality support

Our platform allows you to launch iGaming campaigns in most GEOs, offers fast moderation, and provides hands-on assistance to help you adapt to the new regulatory landscape while keeping your ROI under control