iGaming in India 2026: Bans & Trends That Advertisers Should Know About

In 2025, regulators tightened iGaming advertising rules across major global markets – we covered these changes in detail in our previous article. Unlike other GEOs, India was even stricter and banned the industry entirely.

India's sports betting surged to $6.91 billion in 2024, with forecasts set to hit $16.83 billion by 2033. With cricket, IPL tournaments, and more than 700 million smartphone users, it was ripe for explosive growth. Then, in October 2025, the government passed a law banning all forms of gambling.

This guide breaks down what changed, where demand shifted, and where advertisers can find new opportunities.

The Legislative Shake-Up: What Happened in October 2025

On 1 October 2025, the Promotion and Regulation of Online Gaming Act commenced, outlawing real-money gaming. The restrictions will apply to fantasy sports (Dream11, My11Circle), poker, rummy, and even cricket betting – essentially anything that involves stakes of any sort with the associated game or activity.

The ban hit everyone at once:

-

Banks and payment systems can't execute transactions directed to illicit services

-

Anyone advertising for these services faces a 10 million rupee fine and up to three years in prison

-

Platform owners face up to 3 years in jail for each violation

The outcome was predictable: local businesses shut down, people lost jobs, and sponsors dropped. Over 200,000 employees are at risk. The Supreme Court promised to deliver a final ruling by the end of January 2026, but the market is already beginning to implode.

Industry leaders like Dream11 laid off a third of their staff, Games24x7 stopped hiring, and My11Circle ceased hiring and My11Circle scaled back its advertising budget by fivefold. IPL teams tore up contracts with bettings – early estimates suggested their losses were half a billion rupees.

Offshore Takes Over the Market

The bans didn't decrease activity – they redirected traffic. According to CUTS International, the share of players on offshore platforms jumped from 68.3% to 82% within the first months after restrictions took effect.

The top 15 offshore platforms took in more than 5.8 billion visits from Indians in just one year. That's more than Indian Amazon and Wikipedia combined. Parimatch, 1xBet, Fairplay, and BaterBet dominate the rankings.

The workflow is straightforward:

-

Sites available to users via VPN

-

Links spread through private Telegram and WhatsApp chats

-

Payments are made in cryptocurrency or foreign bank cards

-

Sites are accessed via QR codes and constantly rotating mirrors

-

Withdrawals run through the proxy accounts of residents

The Reserve Bank of India logs $300 million in monthly transactions.

The government is losing substantial revenue: $845 million left the country, and the treasury missed out on $236 million in taxes. The law meant to protect people created a massive black market with no rules or guarantees.

The takeaway for business: people didn't stop playing, they just found alternative ways to access these platforms.

iGaming Trends in India 2026: Where to Place Your Bets

1. Cricket – Primary Traffic Source

Cricket is where the chains are made for the Indian Igaming industry. Millions of bets are placed for every Indian Premier League match. The 2026 schedule is full: Women’s Premier League, ICC Champions Trophy, and T20 leagues in neighbouring countries, to name a few.

The IPL season begins March 22, and the final is set for May 27. Bookmakers are already taking bets on the winner:

-

Mumbai Indians: 5.50

-

Royal Challengers Bengaluru: 6.50

-

Gujarat Titans: 7.50

-

Punjab Kings: 8.00

-

Other teams (Delhi, Kolkata, Lucknow, Hyderabad): 10.00

Offshore platforms attract players with speed and variety. Key advantages include:

-

Live betting with sub-second latency

-

Bet on everything: every ball, every "sixer" (equivalent to a goal), wicket-taking, and exact dismissal methods

-

Crypto payments (these cannot be blocked by banks)

-

Game-specific bonuses (like a free bet if your team makes 6 sixes)

-

Early cash-out before the game finishes

Mumbai Indians and Chennai Super Kings fans consistently generate the most revenue because their audiences are the most engaged. Royal Challengers Bengaluru, although having not yet won any championships, always finds a place among the top three bettors because of Virat Kohli.

The activity peaks in April and May. It is recommended that advertisers go live in January or February, when traffic prices are lower, and there are opportunities to test creative assets. Ad costs can increase by 40-60% by March.

🏆 Register and start launching sports traffic campaigns with EVADAV!

2. Mobile Traffic — The Dominant Format

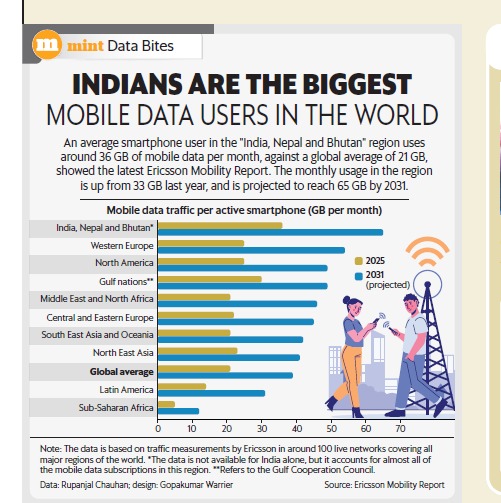

Everything in India happens on smartphones: over 700 million people use them, internet access is inexpensive, and people do everything on their mobiles.

Offshore platforms adapted quickly:

-

Standard apps get removed from stores, so they use progressive web apps (open through browsers)

-

Landing pages load instantly

-

They integrate familiar local wallets – UPI, Paytm, PhonePe

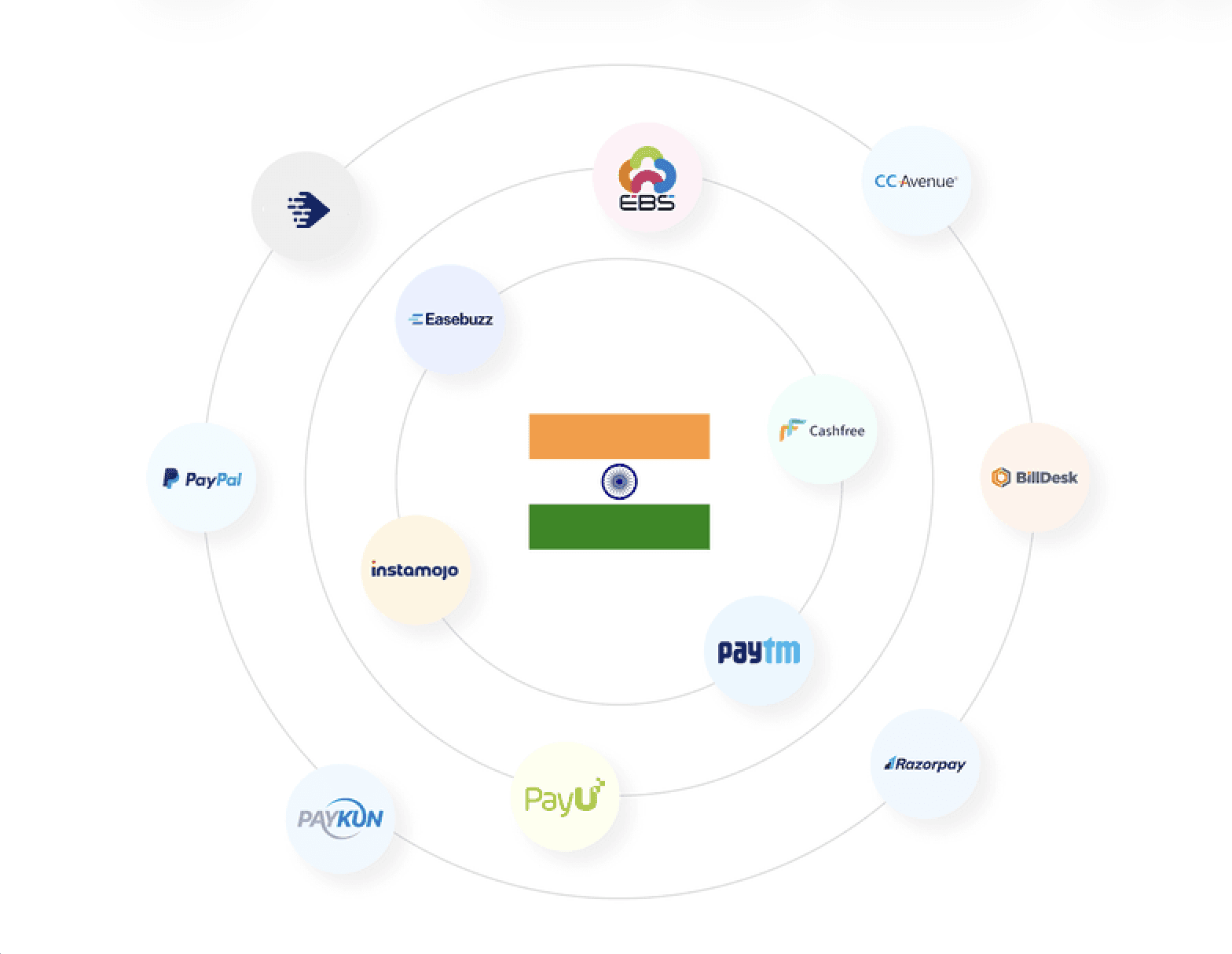

UPI emerged as the main financial instrument in the country, facilitating 18 billion transactions in 2024.

Nearly all foreign services have integrated it:

-

1xBet: minimum deposit is 200 rupees, withdrawal from 1000

-

BC.Game: entry threshold is just 100 rupees (the lowest available)

-

4rabet: works with Paytm, PhonePe, Google Pay, minimum deposit is 300 rupees

The time taken for UPI transactions is 3 to 5 seconds. This becomes important when a person wishes to make a bet during a live event.

Target mobile versions of sites alone. The desktop category alone accounts for less than 12% of this audience.

3. Payment Solutions – The Key to Conversion

As soon as the ban came into effect, banks stopped making direct payments to bookies. But international operators managed to bypass this ban in various ways:

-

Cryptocurrency. Bitcoin, USDT, and Ethereum are now common. Every third player uses them – fast and anonymous

-

UPI via middlemen. Sites allow payments via proxy accounts of local businesses. Banks see this as digital goods purchases or online service payments, so transactions go through

-

Foreign cards. Visa/Mastercard issued outside India works without restrictions

-

Vouchers and wallets. Popular services like AstroPay or Jeton get topped up through local partners, and then funds are transferred to betting accounts

More payment options translate to more conversions. The presence of 5-6 payment options attracts more clients than crypto platforms with limited options.

4. Hybrid Model: Live Streaming + Betting

Betting sites are becoming complete streaming services. Thanks to low-latency video delivery, operators provide access to all of the following in one place:

-

Live broadcasts

-

Live chats where players discuss the game

-

Instant betting: what happens in the next ball, who will be dismissed, and how

-

Detailed statistics and real-time field heat maps

How it works: when viewers place bets on the game they are watching, they will spend more time on the site. Viewers who place wagers through the sites of the bookmakers place an average of three additional wagers than viewers who watch on television.

This is practiced by Stake.bet and Parimatch, whose videos have less than a second of delay, compared to 3-5 seconds for others.

5. Legal Alternatives

Though online real-money gaming is illegal, legal gaming operations shifted into other niches:

-

Social casinos: no real money, revenue comes from ads and chip sales

-

Esports: games like BGMI or Valorant are entirely legal and even government-supported

-

Skill games: chess, quizzes, or card games for points without cash prizes

This market is also developing very rapidly – by the end of 2026, the industry will reach $9.2 billion, according to Outlook India. At the same time, average revenue per user is significantly lower on this market. Users of social casinos bring $2-4, while users of casinos for money bring $80-120 on average. Traffic arbitrageurs do not consider this area a priority.

6. Language and Culture Matter

India can't be treated as a single audience bloc. India is a country comprising dozens of different groups, speaking their own languages and having their own habits:

-

Hindi is understood and spoken by fewer than half (43%) of people, but it's the primary advertising language

-

Local languages (Tamil, Telugu, Marathi, Bengali) perform better: translating pages to users' native languages increases orders by 25%

-

Fan vocabulary: cricket betting ads must use cricket terminology – "sixer," "wicket," "over."

-

Face recognition: images of cricket stars (Virat Kohli, Rohit Sharma) sharply increase ad engagement, though officially using their likenesses is prohibited

Offshore platforms already do so – Parimatch offers a Hindi version, while 1xBet supports 11 Indian languages.

2026 Forecast: What Comes Next

The Supreme Court of India has delayed its decision on the ban on real-money online gaming and will consider it later in January 2026.

There are three possibilities here:

-

1 – Ban extended. Offshore platforms remain engaging viewers, while ad budgets move to "grey zone" strategies: formats with no direct brand references, short funnels, carefully worded communications.

-

2 - Partial Legalization. The most likely route: licensing with strict regulations. The government has greater control, but barriers to entry are higher due to a much tougher creative approval process.

-

3 - Enhanced ban and enforcement crackdown. Pressure on circumvention tools, attempts to shut down access, and prosecution for cooperating with foreign sites. This scenario is less likely, but can’t be completely ruled out.

Until a final decision is made, a pause is put on the market: offshore casinos are also heavily investing to attract Indian players. They will pay for traffic that converts to registration and initial deposits.

What Ad Formats Work in India

Google, Facebook, Instagram, and TikTok prohibit betting and casino advertising. Other alternatives exist:

-

Push notifications. Messages from the sites the users themselves subscribe to. These notifications appear on the devices even when the browsers are closed.

-

In-Page. Appear to be regular notifications and don’t need a subscription. Users are shown these notifications while browsing a site.

-

Popunders. Ads open in a new tab behind the main window. Users see these ads while closing the current page. Suitable for mass media.

-

Native ads. It looks like native content, such as an article suggestion. These blocks are trusted by users and are less often overlooked.

We discussed working with India in-depth in another guide. It analyzes targeting, ad launch timing, and creative types in great detail.

Bottom Line — Speed Wins

The Indian iGaming industry in 2026 has four pillars: offshore gaming sites, VPNs, cricket, and mobile phones. Bans didn’t suppress the need for gambling; they only moved it to an area where those who can navigate the restrictions win.

Key rules for those looking to profit:

-

Catch the moment. The major cricket tournament (IPL) starts on March 22. Launch ads in January-February before prices spike.

-

Forget desktops. All traffic goes through phones. Ads, sites, payments – everything must be mobile-optimized.

-

Use the proper channels. Push, In-Page, Popunder, and Native formats remain effective for iGaming campaigns.

-

Speak the customer's language. Use Hindi and local languages, include cricket terminology, and integrate UPI payments.

-

Expand payment options. Sites accepting UPI get more conversions than crypto-only platforms.

There are similar cases in other neighboring countries. If you’re considering an extension, I would recommend checking our other travel guides for Indonesia or the Philippines for similar advice.

Launch with EVADAV – we know how to deal with the Asian and Indian markets

We provide simple moderation for gaming ads, quick campaign approval, and account managers who will point out the best ad formats and configurations for your campaign. The minimum balance replenishment starts at $100, though we recommend launching ads with $500+ for more relevant results and reliable analytics. For a solid test of different angles and approaches, use $3,000 – this will give you a specified full-service for your campaigns from the ad managers. The secret to success here is to launch before the season starts in order to get cheaper traffic and test various campaigns before the March-April rush.